In the crypto market, making profitable investments can feel like navigating through a fog. Many investment strategies rush head-on into volatility, bringing you significant risk. But one popular approach to investing safely is the long/short trading strategy. By taking advantage of bullish and bearish market conditions, this strategy is immune to market direction. But what is this strategy and why is it gaining popularity?

What is Long/Short in Trading?

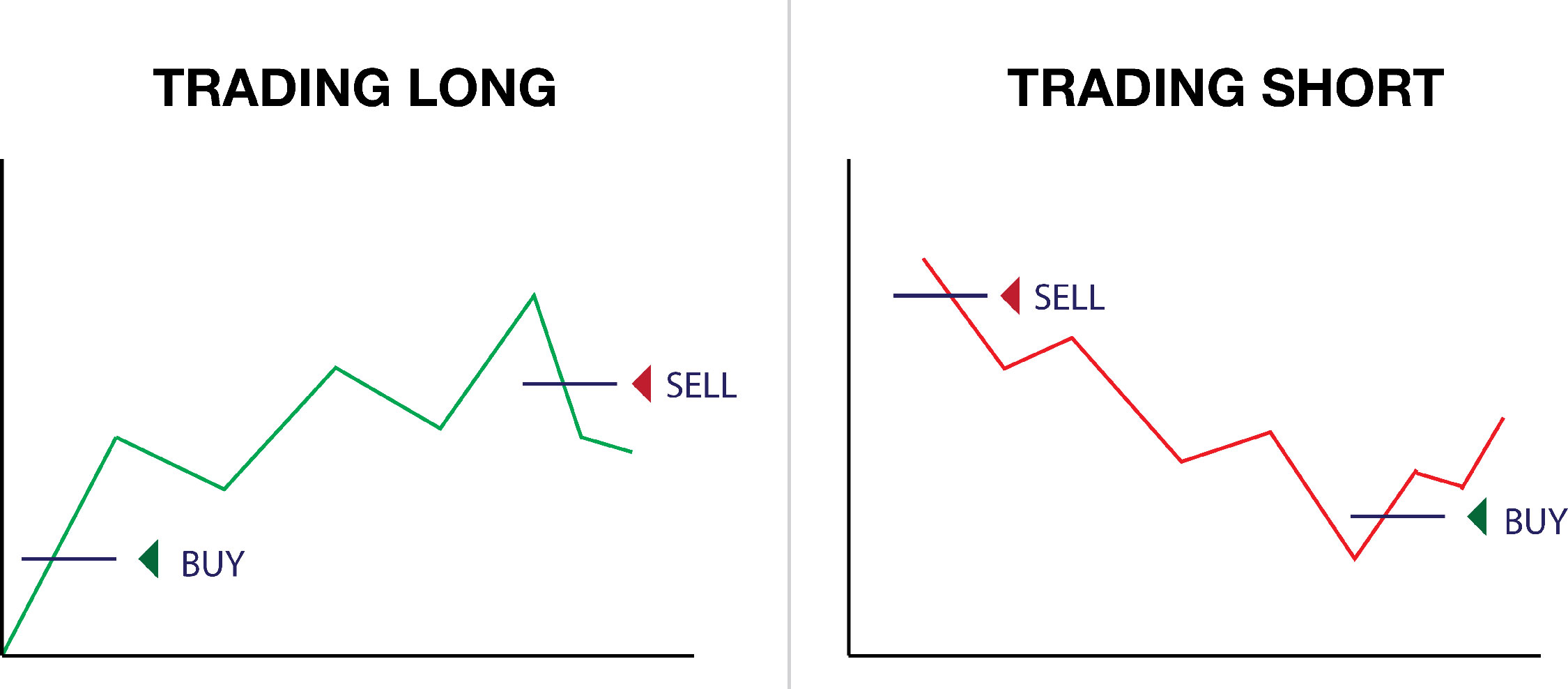

In trading, long and short refer to a trader’s position in an asset or security. Long means the trader has bought an asset, expecting a rise in its price. If the asset’s price does increase, the trader can sell it at a profit.

On the other hand, a “short” position means that a trader has sold an asset, expecting the price to fall. If its price does decrease, the trader can buy back at a lower price, making a profit.

This is a popular investment strategy used by hedge funds. In a long-short equity hedge fund, the fund manager simultaneously buys long positions in some stocks and short positions in others. The goal of a long short fund is to generate profits regardless of whether the overall market is trending up or down.

Read more: Cryptocurrency trading

What is Long and Short in Crypto Trading?

In crypto trading strategies, long and short positions are used in the same context as traditional markets. You long an asset when you expect the price to rise, and short when the price may go down. But there are some crucial differences in how this process is implemented.

Firstly, the crypto market is much more volatile than the stock markets. This means your potential gains and losses from longs and shorts are much higher when trading crypto. Second, there are no brokers in the crypto ecosystem. This requires exchanges to provide other methods for shorting.

Long VS Short Trading

As mentioned above, choosing between long and short trades depends on the asset you are considering. If you believe your token of choice is going to go up, you can buy it and hold it. Otherwise, if its position in the market seems too high, you can short it.

Choosing a long-short strategy is based on reducing risk and the impact of overall market movements. If you isolate your portfolio against market trends, your profits are based purely on relative performance.

Join our Cryptoors Army Make 100x

How To Long and Short Crypto?

Longing crypto requires you to buy tokens from any exchange. On a centralized exchange, this means creating an account with the provider and adding funds. But decentralized exchanges need you to create and connect a crypto wallet with the platform.

There are two ways to borrow tokens for short positions. On a centralized exchange, this provision is provided directly by the platform. However, decentralized exchanges do not have any service providers. Instead, tokens can be borrowed using liquidity pools or other DeFi applications.

What are Some Crypto Long Short Trading Strategies?

Here are some popular crypto long-short trading strategies.

- Market-neutral strategy: In this strategy, you take both long and short positions in similar crypto tokens or indexes. The idea is to eliminate the impact of the overall market on your portfolio and rely on the relative performance of assets.

- Pair trading strategy: In this strategy, you select two correlated tokens and take a long position in one and a short position in the other. The aim is to profit from the price difference between the two.

- Event-driven strategy: This strategy involves taking long and short positions based on specific events that are likely to impact the market. This includes regulatory changes, hard forks, or other major news.

- Trend-following strategy: In this strategy, you take long and short positions based on the direction of the trend. For example, if the market is in an uptrend, you take long positions, and if it’s in a downtrend, you take short positions.

Long and Short Crypto Example

Here’s an example of how a long/short strategy might work: Let’s say you are a crypto fund manager. You believe that ETH will rise in the coming months, while the BTC price will fall. You will choose to purchase long positions in ETH and short positions in BTC. If your predictions are correct and the ETH price rises and the BTC stock price falls, the fund will generate profits in both positions.

The long/short strategy allows you to take advantage of both bullish and bearish market conditions. Additionally, this strategy allows you to manage risk by hedging your positions. For example, if the overall market experiences a downturn, your short positions may offset losses in the long positions.

Read more: how to make 100x profit with shit coins

Conclusion

While there are many different hedge fund strategies you can use, the crypto long-short strategy is one of the simplest and most effective. It involves analysing crypto projects and determining whether to take long or short positions in them. If you want to eliminate the impact of the overall market, this strategy can be good for you. However, you must ensure that you do extensive research before trading/investing in the crypto markets.

Join our Cryptoors Army Make 100x

2 comments on How to trade Long And Short – Earn $1000 per day with crypto