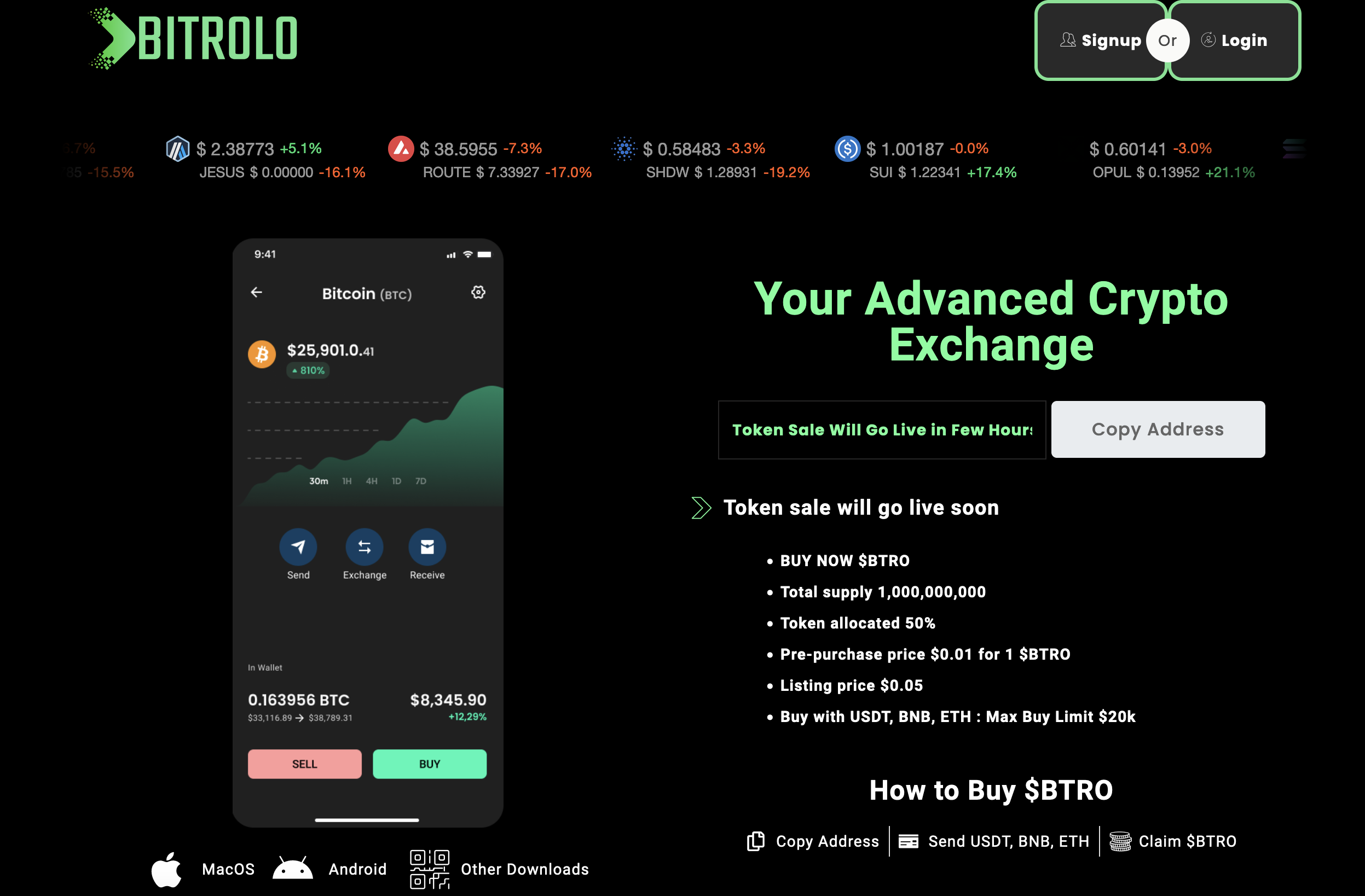

Unveiling Bitrolo: A Comprehensive Guide to the Upcoming Token Sale and Exciting Features Bitrolo.com, the much-anticipated cryptocurrency exchange, is set to revolutionize the digital asset landscape with its innovative suite of products and an upcoming token sale. In this article, we’ll delve into the key features of Bitrolo and the details surrounding its imminent token sale. Bitrolo’s Product Lineup: 1. Spot, Margin, and Futures Markets: Bitrolo.com is poised to offer a diverse range of trading options, including spot, margin, and futures markets. Traders can explore various strategies to maximize their returns with the flexibility these markets provide. 2. P2P Trading Platform: Bitrolo’s P2P trading platform aims to simplify and enhance the peer-to-peer trading experience. Users can engage in secure and direct transactions, fostering a decentralized approach to trading. Clickable Box Sol Swap SLP ICO is live BUY This 1000x Coin Buy SLP Now / 3. NFT Marketplace – Buy and Sell: The rise of non-fungible tokens (NFTs) has captured the imagination of the crypto community. Bitrolo.com will soon introduce its NFT marketplace, allowing users to buy and sell unique digital assets in a seamless and secure environment. 4. Launchpad: Bitrolo’s Launchpad is designed to support the launch of new projects within the crypto space. This feature will facilitate fundraising and provide a platform for promising projects to gain visibility and support. 5. Earn’ 10% APY Interest: Bitrolo’s ‘Earn’ feature offers users the opportunity to earn a competitive 10% Annual Percentage Yield (APY) on their holdings, providing a passive income stream for investors. 6. Trading Rewards – Up to $80,000: Traders on Bitrolo.com will be eligible for exciting rewards through the Trading Rewards program. With rewards reaching up to $80,000, users can amplify their gains by actively participating in the platform. Token Sale Details: Token Sale Launch: The eagerly awaited Bitrolo token sale is on the horizon, promising an opportunity for early supporters to secure their stake in the platform’s success. Token Information: – Token Name: $BTRO – Total Supply: 1,000,000,000 – Token Allocation: 50% Pricing Details: – Pre-purchase Price: $0.01 for 1 $BTRO – Listing Price: $0.05 Payment Options: Interested participants can buy $BTRO using USDT, BNB, or ETH. The maximum buy limit is set at $20,000, providing flexibility for both small and large investors. Conclusion: Bitrolo.com is not just another crypto exchange; it’s a comprehensive ecosystem catering to the diverse needs of the crypto community. As the token sale approaches, the opportunity to be part of this groundbreaking platform becomes increasingly enticing. Stay tuned for the official launch, and don’t miss your chance to be part of the future of digital asset trading with Bitrolo.com. Bitrolo Official Links Website: https://bitrolo.com X (Twitter): https://twitter.com/bitroloexchange Telegram: https://t.me/bitrolo