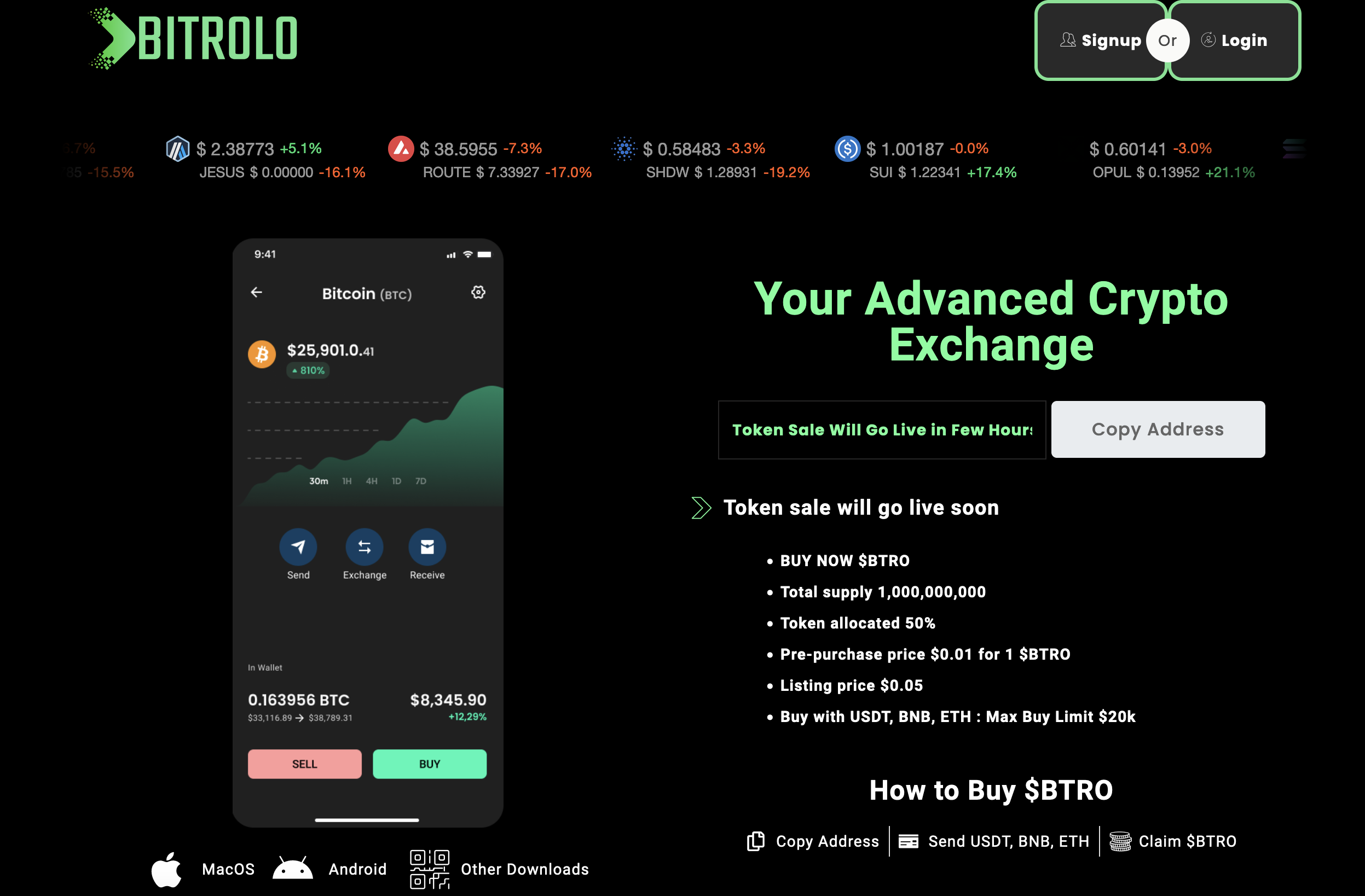

The debut of the Saga Mobile from Solana Phone, a subsidiary of Solana Labs, signals a noteworthy foray into the mobile market with a distinct emphasis on incorporating blockchain technology. This Android smartphone endeavors to seamlessly merge traditional mobile functionalities with the unique capabilities of the Solana blockchain. Targeting a niche audience, specifically those immersed in the digital assets and blockchain realm, this article seeks to provide an impartial analysis of the Solana Phone’s purpose, features, use cases, and practical applications, shedding light on the demographic that stands to benefit the most from this innovative device. Purpose of the Solana Mobile Saga Phone: The Solana Phone’s primary goal is to streamline the integration of blockchain technology into everyday mobile usage, catering particularly to users actively involved in cryptocurrency, NFTs, and the broader digital asset markets. Designed to simplify the management and transaction of digital assets, the phone offers a native platform for these activities. It appears to be a specialized tool for individuals who prioritize blockchain functionality in their mobile devices. Key Features: Solana Phone Equipped with features supporting its blockchain-centric design, the Solana Phone boasts a 6.67″ OLED display, 12 GB RAM, and 512 GB of storage, aligning it with other high-end smartphones in terms of basic specifications. Operating on the Snapdragon® 8+ Gen 1 Mobile Platform, a notable feature is the Solana Mobile Stack’s Seed Vault, enhancing the security of digital assets. This Seed Vault securely stores private keys and seed phrases, critical for cryptocurrency and NFT transactions, providing an added layer of protection against potential digital threats. Clickable Box Sol Swap SLP ICO is live BUY This 1000x Coin Buy SLP Now / Use Cases and Real-World Utilities: Tailored for specific use cases, the Solana Phone is particularly appealing to those deeply entrenched in the cryptocurrency and blockchain ecosystem. Its integration with the Solana blockchain facilitates seamless management and trading of digital assets directly from the phone. This functionality is especially useful for cryptocurrency traders, NFT collectors, and developers requiring constant access to their digital wallets and assets. Furthermore, its capacity to handle decentralized applications (dApps) can offer a more streamlined user experience for those frequently using such applications. Potential Limitations and Considerations: While offering unique features for blockchain enthusiasts, Solana Phone potential limitations must be considered. The niche focus on blockchain functionality may not appeal to the general smartphone user prioritizing features like camera quality, ecosystem preference (iOS vs. Android), or brand loyalty. Additionally, the integration of blockchain technology in a smartphone is still a relatively new concept, raising questions about long-term support, updates, and compatibility with evolving blockchain technologies. Conclusion: The Solana Mobile Saga Phone signifies a significant step towards integrating blockchain technology into mainstream mobile devices. Its specialized features and functionalities make it an enticing option for individuals actively engaged in the digital asset space. However, its niche focus may limit its appeal in the broader smartphone market. Understanding the target audience and specific use cases is crucial for potential users considering its purchase. It acts as a bridge between conventional mobile technology and the burgeoning world of blockchain, offering a unique proposition for a specific segment of the market.